TSMC Reports First Quarter EPS of NT$8.70

HSINCHU, Taiwan, R.O.C., Apr. 18, 2024 -- TSMC (TWSE: 2330, NYSE: TSM) today

announced consolidated revenue of NT$592.64 billion, net income of NT$225.49 billion, and

diluted earnings per share of NT$8.70 (US$1.38 per ADR unit) for the first quarter ended March

31, 2024.

Year-over-year, first quarter revenue increased 16.5% while net income and diluted EPS both

increased 8.9%. Compared to fourth quarter 2023, first quarter results represented a 5.3%

decrease in revenue and a 5.5% decrease in net income. All figures were prepared in accordance

with TIFRS on a consolidated basis.

In US dollars, first quarter revenue was $18.87 billion, which increased 12.9% year-over-year but

decreased 3.8% from the previous quarter.

Gross margin for the quarter was 53.1%, operating margin was 42.0%, and net profit margin was

38.0%.

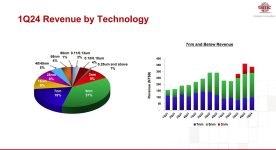

In the first quarter, shipments of 3-nanometer accounted for 9% of total wafer revenue; 5-

nanometer accounted for 37%; 7-nanometer accounted for 19%. Advanced technologies, defined

as 7-nanometer and more advanced technologies, accounted for 65% of total wafer revenue.

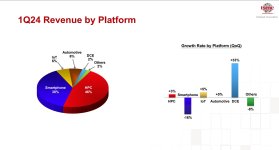

“Our business in the first quarter was impacted by smartphone seasonality, partially offset by

continued HPC-related demand,” said Wendell Huang, Senior VP and Chief Financial Officer of

TSMC. “Moving into second quarter 2024, we expect our business to be supported by strong

demand for our industry-leading 3nm and 5nm technologies, partially offset by continued

smartphone seasonality.”

Based on the Company’s current business outlook, management expects the overall performance

for second quarter 2024 to be as follows:

• Revenue is expected to be between US$19.6 billion and US$20.4 billion;

And, based on the exchange rate assumption of 1 US dollar to 32.3 NT dollars,

• Gross profit margin is expected to be between 51% and 53%;

• Operating profit margin is expected to be between 40% and 42%.

2Q24 Guidance

◼ Revenue to be between US$19.6 billion and US$20.4 billion

Based on our current business outlook, management expects: And, based on the exchange rate assumption of 1 US dollar to 32.3 NT dollars, management expects:

◼ Gross profit margin to be between 51% and 53%

◼ Operating profit margin to be between 40% and 42%

◼ TSMC maintained its 2024 CapEx target at $28-32B

◼ TSMC expects the 50%+ AI revenue CAGR to be sustained through 2028

◼ TSMC hints at price hikes

◼ TSMC maintains its own outlook for 2024 (AI fueled)

RECAP OF MAJOR EVENTS

• TSMC Announces Candidates for Board of Directors (2024/04/12)

• TSMC Arizona and U.S. Department of Commerce Announce up to US$6.6 Billion in Proposed CHIPS Act Direct Funding, the Company Plans Third Leading-Edge Fab in Phoenix (2024/04/08)

• TSMC Board of Directors Hold a Special Meeting and Approve the Appointment of Senior Vice President of R&D Dr. Y.J. Mii and Senior Vice President of Operations Mr. Y.P. Chyn as Executive Vice Presidents and Co-Chief Operating Officers of TSMC (2024/02/29)

• TSMC Celebrates the Opening of JASM in Kumamoto, Japan (2024/02/24)

• JASM Set to Expand in Kumamoto, Japan (2024/02/06)

• TSMC Board of Directors Approved NT$3.50 Cash Dividend for the Fourth Quarter of 2023 and Set June13, 2024 as Ex-Dividend Date, June 19, 2024 as the Record Date, and July 11, 2024 as the Distribution Date (2024/02/06)

• TSMC Board of Directors Approved the Convening of the 2024 Annual Shareholders’ Meeting on June 4,2024, at Which an Election for its Ten-Member Board of Directors Will Be Held (2024/02/06)

......

HSINCHU, Taiwan, R.O.C., Apr. 18, 2024 -- TSMC (TWSE: 2330, NYSE: TSM) today

announced consolidated revenue of NT$592.64 billion, net income of NT$225.49 billion, and

diluted earnings per share of NT$8.70 (US$1.38 per ADR unit) for the first quarter ended March

31, 2024.

Year-over-year, first quarter revenue increased 16.5% while net income and diluted EPS both

increased 8.9%. Compared to fourth quarter 2023, first quarter results represented a 5.3%

decrease in revenue and a 5.5% decrease in net income. All figures were prepared in accordance

with TIFRS on a consolidated basis.

In US dollars, first quarter revenue was $18.87 billion, which increased 12.9% year-over-year but

decreased 3.8% from the previous quarter.

Gross margin for the quarter was 53.1%, operating margin was 42.0%, and net profit margin was

38.0%.

In the first quarter, shipments of 3-nanometer accounted for 9% of total wafer revenue; 5-

nanometer accounted for 37%; 7-nanometer accounted for 19%. Advanced technologies, defined

as 7-nanometer and more advanced technologies, accounted for 65% of total wafer revenue.

“Our business in the first quarter was impacted by smartphone seasonality, partially offset by

continued HPC-related demand,” said Wendell Huang, Senior VP and Chief Financial Officer of

TSMC. “Moving into second quarter 2024, we expect our business to be supported by strong

demand for our industry-leading 3nm and 5nm technologies, partially offset by continued

smartphone seasonality.”

Based on the Company’s current business outlook, management expects the overall performance

for second quarter 2024 to be as follows:

• Revenue is expected to be between US$19.6 billion and US$20.4 billion;

And, based on the exchange rate assumption of 1 US dollar to 32.3 NT dollars,

• Gross profit margin is expected to be between 51% and 53%;

• Operating profit margin is expected to be between 40% and 42%.

2Q24 Guidance

◼ Revenue to be between US$19.6 billion and US$20.4 billion

Based on our current business outlook, management expects: And, based on the exchange rate assumption of 1 US dollar to 32.3 NT dollars, management expects:

◼ Gross profit margin to be between 51% and 53%

◼ Operating profit margin to be between 40% and 42%

◼ TSMC maintained its 2024 CapEx target at $28-32B

◼ TSMC expects the 50%+ AI revenue CAGR to be sustained through 2028

◼ TSMC hints at price hikes

◼ TSMC maintains its own outlook for 2024 (AI fueled)

RECAP OF MAJOR EVENTS

• TSMC Announces Candidates for Board of Directors (2024/04/12)

• TSMC Arizona and U.S. Department of Commerce Announce up to US$6.6 Billion in Proposed CHIPS Act Direct Funding, the Company Plans Third Leading-Edge Fab in Phoenix (2024/04/08)

• TSMC Board of Directors Hold a Special Meeting and Approve the Appointment of Senior Vice President of R&D Dr. Y.J. Mii and Senior Vice President of Operations Mr. Y.P. Chyn as Executive Vice Presidents and Co-Chief Operating Officers of TSMC (2024/02/29)

• TSMC Celebrates the Opening of JASM in Kumamoto, Japan (2024/02/24)

• JASM Set to Expand in Kumamoto, Japan (2024/02/06)

• TSMC Board of Directors Approved NT$3.50 Cash Dividend for the Fourth Quarter of 2023 and Set June13, 2024 as Ex-Dividend Date, June 19, 2024 as the Record Date, and July 11, 2024 as the Distribution Date (2024/02/06)

• TSMC Board of Directors Approved the Convening of the 2024 Annual Shareholders’ Meeting on June 4,2024, at Which an Election for its Ten-Member Board of Directors Will Be Held (2024/02/06)

......