An overview of last quarters result

CLAUS AASHOLM

APR 16, 2024

The state of the semiconductor foundry market is key to understanding the dynamics of the semiconductor industry. The results of the foundry companies precede that of the semiconductor industry and can give an idea of what is next. Looking deeper into the supply chain is looking further into the future.

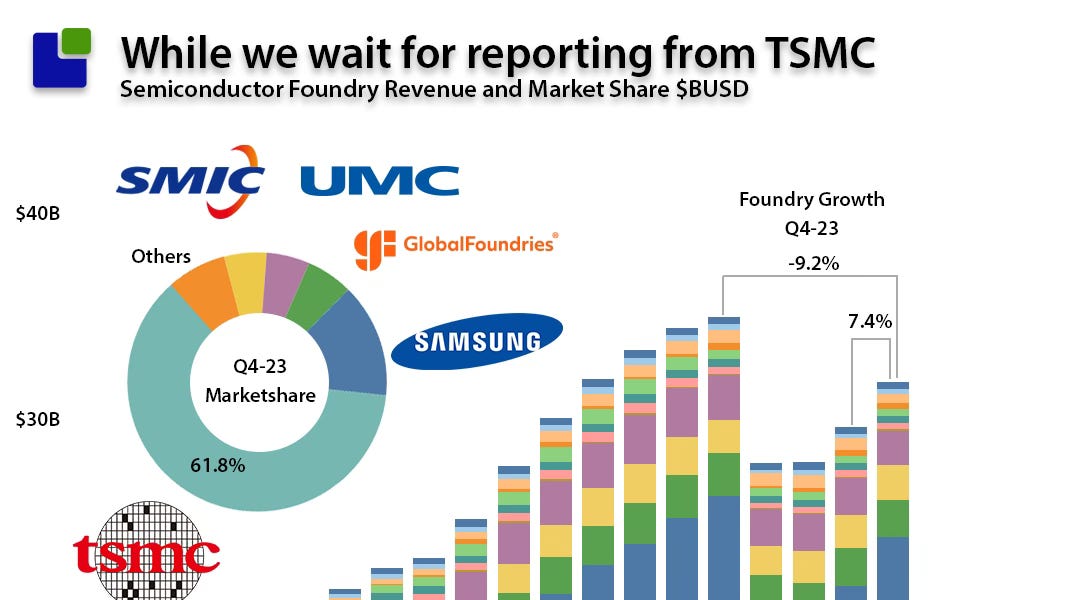

As TSMC reports monthly revenue, we already know that Q1-24 revenue was down 3.9% sequentially from $19.6B to $18.8B, while revenue was up 13.1% over the same quarter last year (We calculate growth in USD to compare the entire industry).

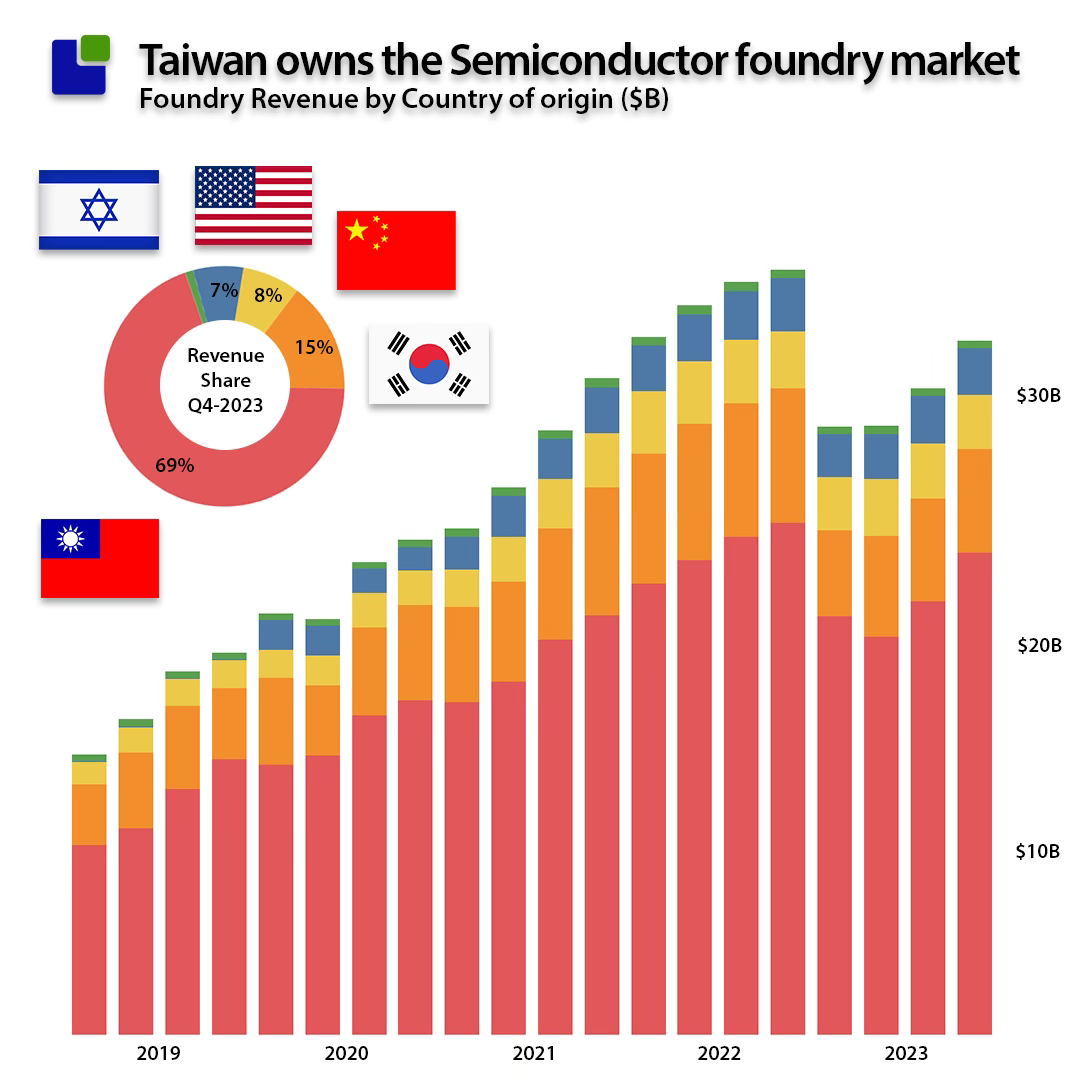

As TSMC accounts for more than 60% of the foundry market, it is key to understand the companies' results in more detail to understand what goes on in the foundry market, but in the meantime, it is worth looking at last quarter's results.

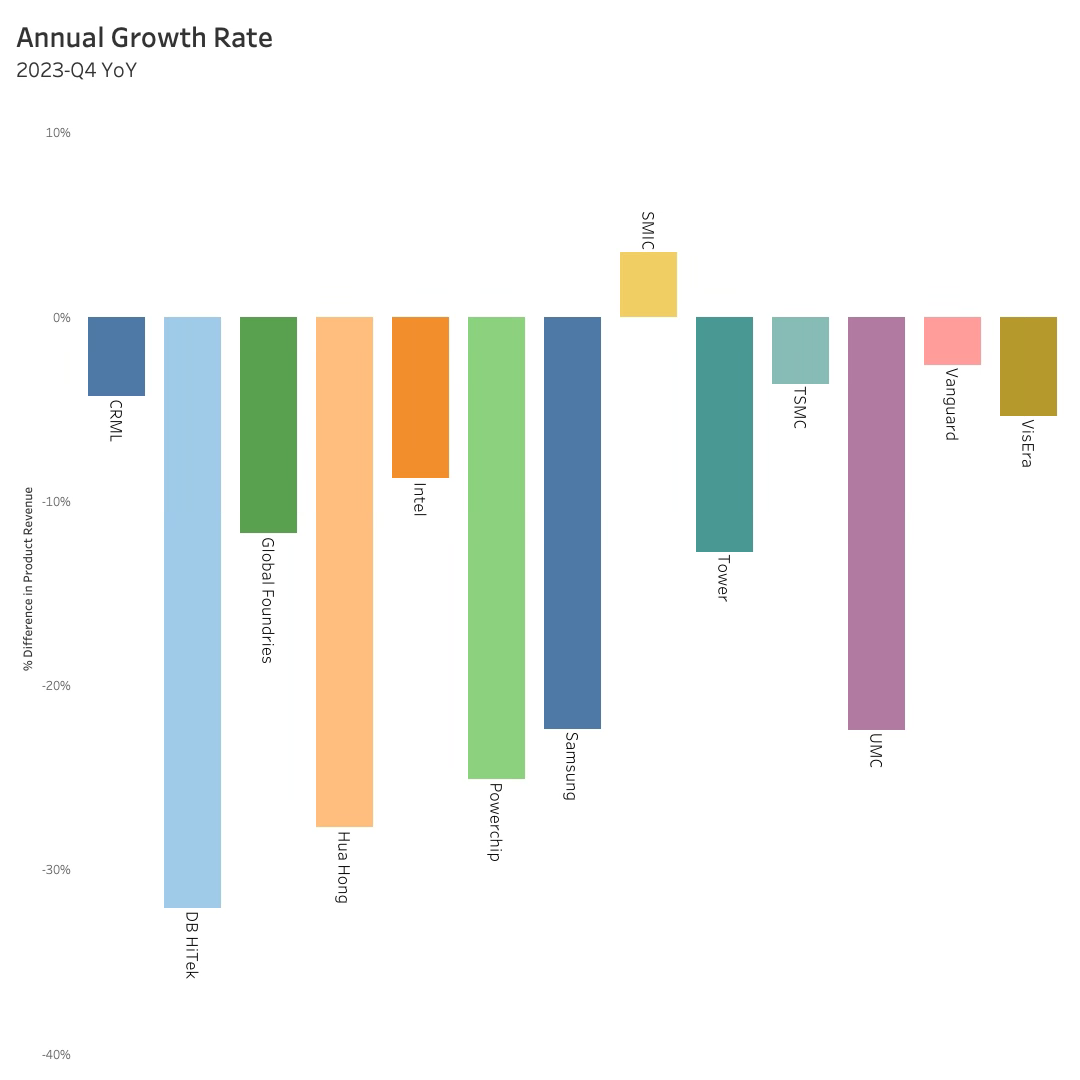

The industry increased revenue by 7.4% sequentially, declining 9.2% from Q4-22, starting to climb out of the steep drop in Q1-2023.

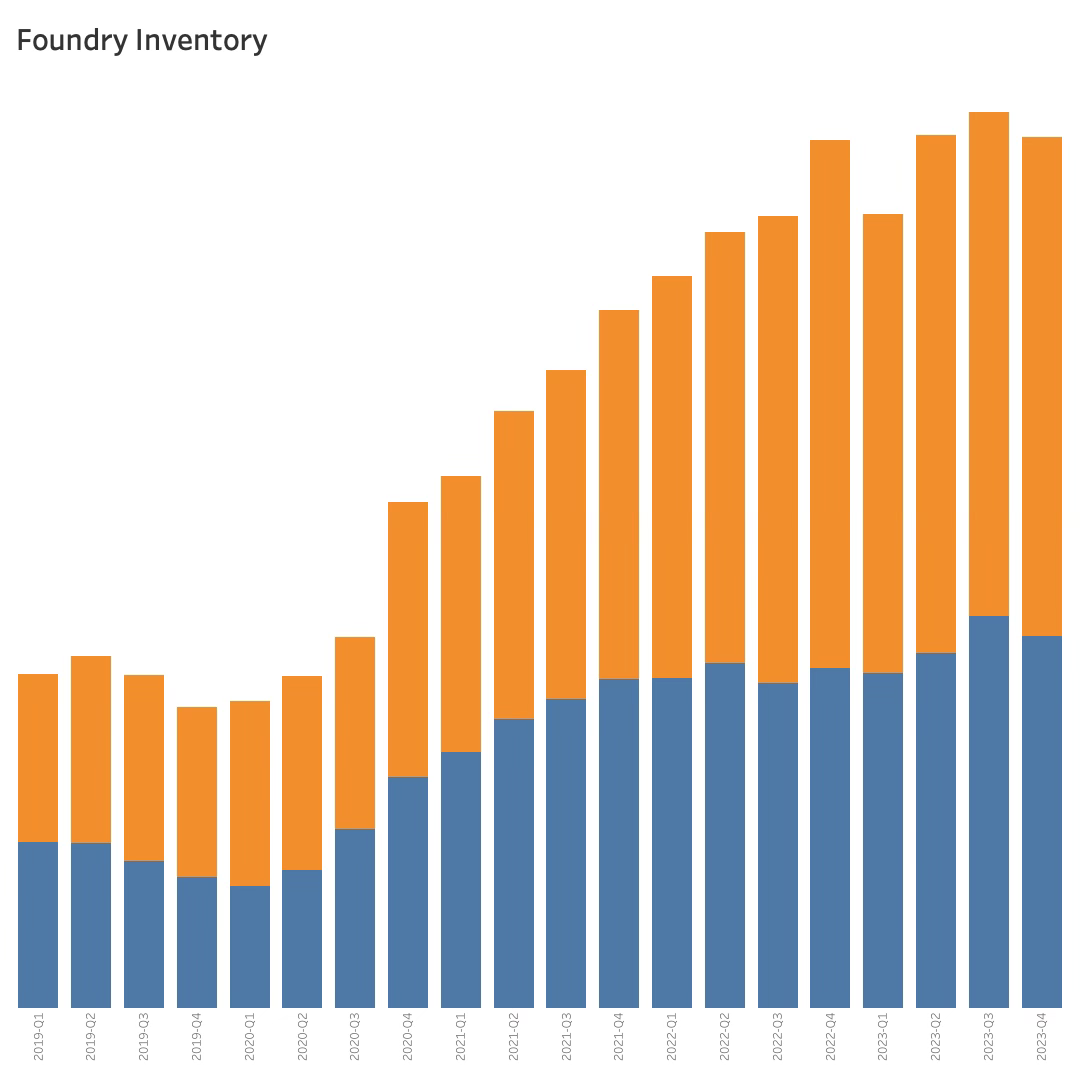

While inventories have grown more than revenue over time, there was no dramatic effect on the foundries' total inventory levels, suggesting that the drop was expected and could be controlled. TSMC in blue is running at lower inventory levels than the rest of the industry, suggesting that the scale of the business allows for more efficient supply chain management than the smaller competitors.

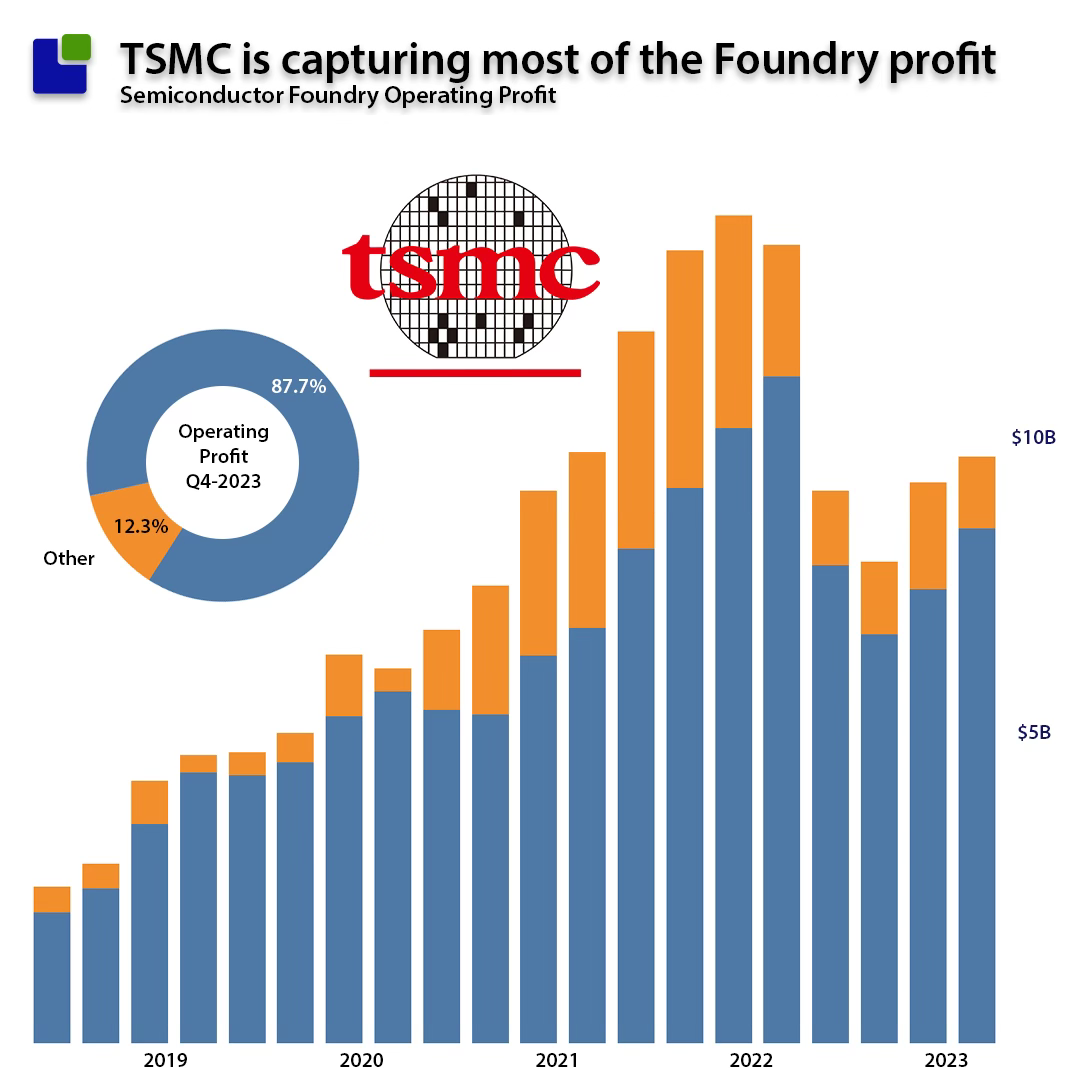

This can also be seen from an operating profit perspective.

While operating profits are dispersed more in a growing market, TSMC can clearly weather downturns better than its smaller competitors. In Q4-23, the Taiwanese giant captured more than 88% of the total operating profit in the industry.

Concerns have been voiced about TSMC's dominance in the Taiwanese economy. The semiconductor powerhouse has higher revenue than Taiwan's 10 next-largest companies. At the same time, TSMC ensures Taiwan's leadership in the semiconductor industry.

This dominance is the target of the US Chips Act of 2022 and Intel’s latest IFS strategy. The USA is now viewing Semiconductor manufacturing as a matter of national security.

In Q4-23, only one foundry, SMIC of China, managed to beat the revenue of Q4-22:

If TSMC’s revenue result for Q1-24 is any guidance, the foundry market will continue its recovery. TSMC grew Q1 revenue by 3.9% compared to the same quarter in 2023.

The foundry market, as a whole, declined 9.2% in Q4-23 compared to Q4-22.

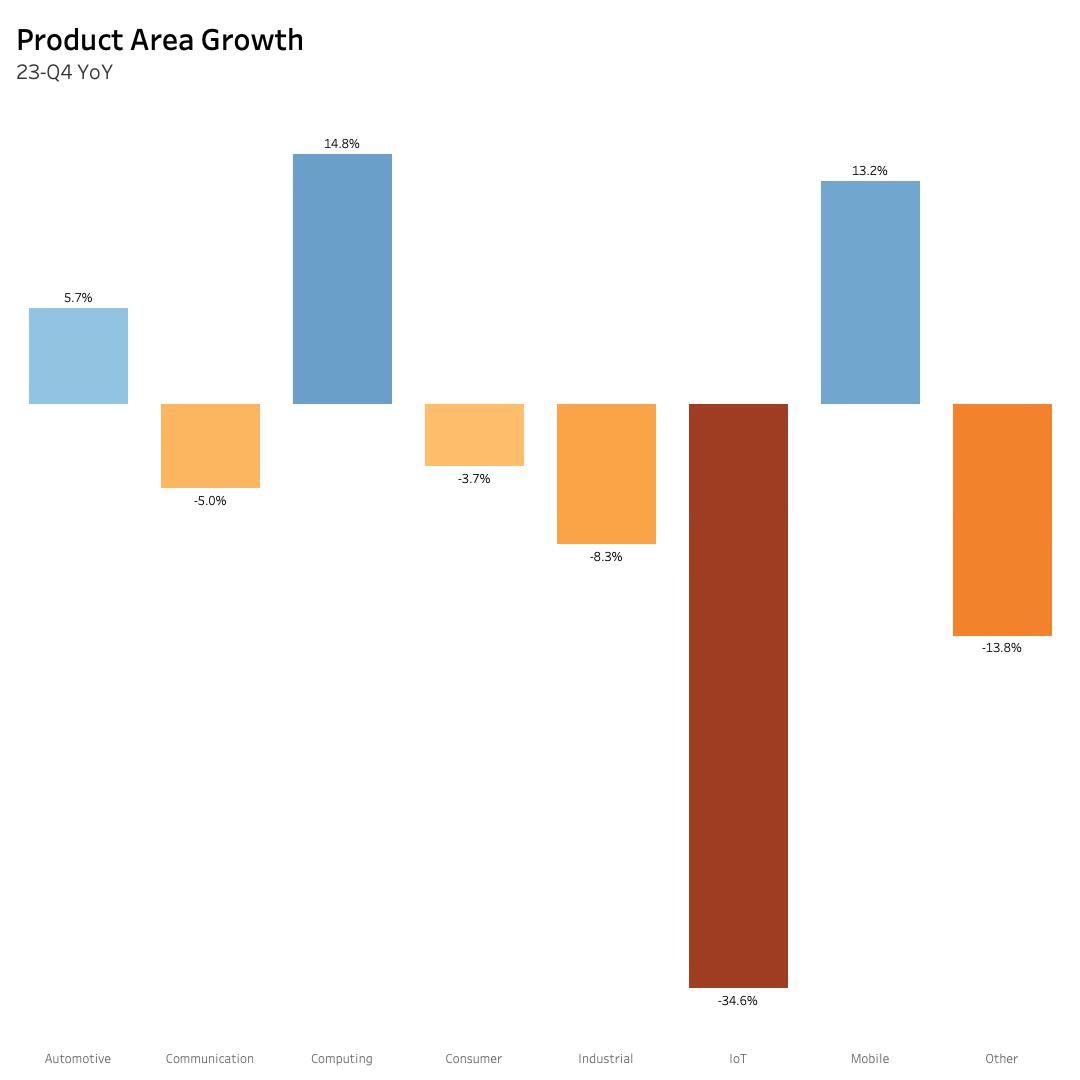

Things get interesting by looking at the manufacturing categories of the foundries and how they are impacted.

This analysis from 2.5 months ago predicted the generally soft market of the Semiconductor fabless companies. The growth in computing was visible then, as was the continued strength in automotive semiconductors. What was less obvious was the gain in mobile semiconductors. This has not been visible to the market until now, when reports about an increase in mobile phone sales are starting to appear.

The analysis also shows that the IoT market is in a deep recession, best exemplified by the abysmal results of pure-play IoT companies like Silicon Labs and Nordic Semiconductor. It does not look like a recovery is near.

Communication, industrial, and consumer were also depressed but could rebound this quarter.

Digging into details on the foundry business is like looking into the future of the fabless semiconductor companies and their markets.

The state of the Foundry market before TSMC reports

An overview of last quarters result