Patrick Gelsinger

Thanks, John, and welcome, everyone. We reported solid Q1 results, delivering revenue in-line and EPS above our guidance as we continue to focus on operating leverage and expense management. Our results reflect our disciplined approach on reducing costs as well as the steady progress we are making against our long-term priorities.

While first-half trends are modestly weaker than we originally anticipated, they are consistent with what others have said and also reflect some of our own near-term supply constraints. We continue to see Q1 as the bottom and we expect sequential revenue growth to strengthen throughout the year and into 2025, underpinned by, one, the beginnings of an enterprise refresh cycle and growing momentum for AIPCs. Two, a data center recovery with a return to more normal CPU buying patterns and ramping of our accelerator offerings. And three, cyclical recoveries in NEX, Mobileye and Altera.

We had an extremely productive Q1 and achieved several important milestones along our journey to reposition the company for improved execution, competitiveness and perhaps most importantly, financial results. We hosted our first-ever Intel Foundry Direct Connect, which drew nearly 300 partners, customers and potential customers to hear about the momentum we are building with our foundry offerings.

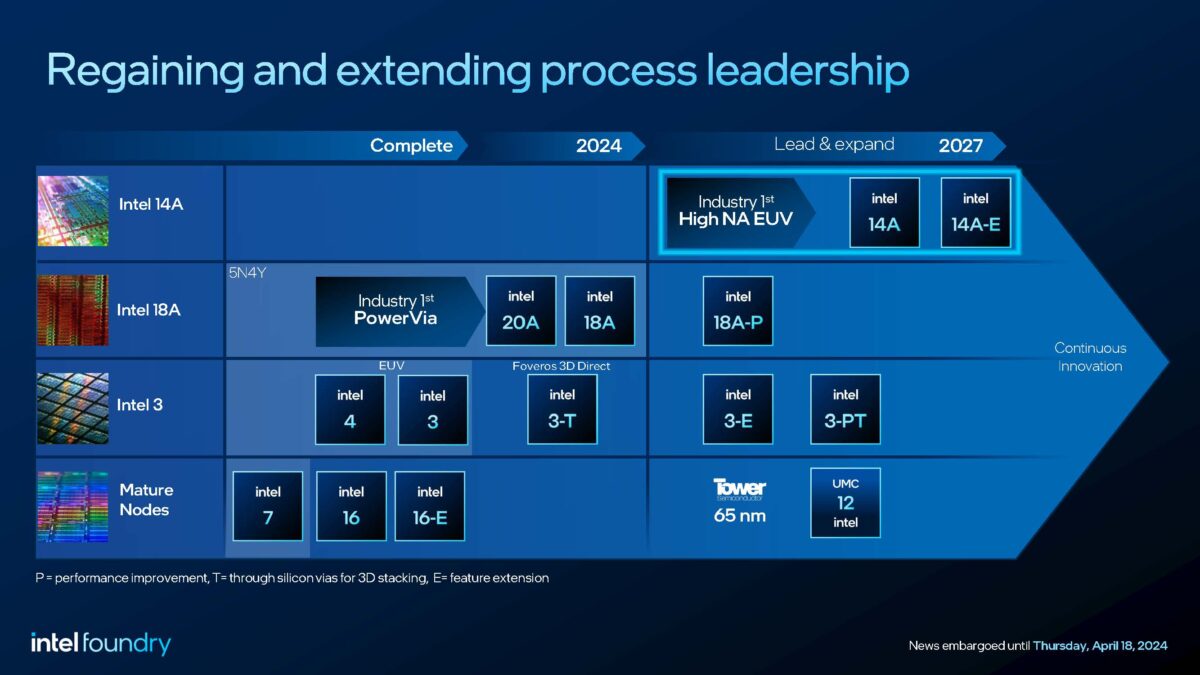

We were pleased to announce Microsoft as our fifth Intel 18A customer. We also updated our lifetime deal value to greater than 15 billion and extended our roadmap with Intel 14A, the first process node in the industry to use High NA EUV technology.

Shortly following Direct Connect, we were thrilled to join with President Biden and Commerce Secretary, Raimondo to announce our position as the national semiconductor champion, along with the single largest award from the CHIPS and Science Act of more than 45 billion of proposed grants, tax incentives and loans.

During the second week of April, we brought together more than 1,000 of our top customers and partners at Intel Vision 2024, where we introduced our next-generation Gaudi 3 accelerator. We were joined by NAVER, Dell, Bosch, Supermicro and Roche, among many others who shared how they are benefiting from Intel solutions.

Vision led straight into Open Source Summit, where we led the launch of the Open Platform for Enterprise AI project. This industry initiative aims to accelerate GenAI deployments in what will be the largest market for AI applications starting with retrieval augmented generation or RAG. Our Xeon plus Gaudi use cases along with our established enterprise ecosystem have a big role to play here.

Lastly, we hosted the industry's first sustainability summit, underscoring our deep commitment to building a more geographically diverse, resilient, trusted and of course, sustainable supply-chain for semiconductors. We are proud of our leadership position in chemical conservation, renewable energy and water reclamation.

Our accomplishments year-to-date build on all the work we have done to executing the strategy I laid out when I rejoined the company three years ago. Job number one was to accelerate our efforts to close the technology gap that was created by over a decade of underinvestment. The heart of Phase 1 was five nodes in four years. The rallying cry was torrid. It combined accelerating our node transitions with improving our product execution and cadence to regain customer trust.

We have rebuilt our Grovian culture and execution engine and are on track to completing our five nodes four year goal, which many of our stakeholders thought impossible at inception. In so doing, we are in a unique position with at-scale EUV technology, Western base capacity, and at the very least, a level playing field with the market leader.

Intel 20A, which helps pave the way for Intel 18A, begins production ramp in the second-half of this year with Arrow Lake. We expect to release the 1.0 PDK for Intel 18A this quarter. Furthermore, our lead products, Clearwater Forest and Panther Lake are already in fab and we expect to begin production ramp of the Intel 18A in these products in the first-half of '25 for product release in the middle of next year. Given this progress, now is the time to turn our focus to matching technology leadership with a competitive cost structure.

Establishing a foundry relationship between our products group and our manufacturing group was a critical step to achieve better structural cost. This quarter, we officially transitioned to our new operating model and introduced Intel Products and Intel Foundry. Today, for the first time, we are reporting our results to reflect the new way in which we are running the company.

Separating the internal financial reporting between Intel Foundry and Intel products was a critical step needed to provide transparency, accountability and the proper incentives to allow both groups to make better decisions to optimize their own cost structures.

This change also provided the added benefit of giving more transparency to our outside owners. We knew that the day one P&L for Intel Foundry was going to spark debate, but we also knew it was important to establish a baseline and provide a target model based on reasonable to conservative revenue and cost assumptions that we have a high degree of confidence we will achieve.

I'm going to reiterate that point, so it is heard and understood. Our target model is reasonable, conservative and reflects a high degree of confidence in our ability to deliver. And you can rest assured that we will be working hard to beat these targets. If we can move faster and do better, we will and our new operating model is already catalyzing change and driving efficiencies across the organization. Let me highlight three important aspects of our business and our strategy that is underscored by the new model.

First, with Intel Products, we have exposed a solid, fabless franchise with established powerful and hard to displace installed-base and ecosystem across enterprise, consumer and edge that provide meaningful benefits to our customers and partners. Intel Products is a solidly profitable business today, despite just recently emerging from a semiconductor downturn and still competing with legacy process technology. That is changing rapidly as we ramp Intel 3 in 2024 and Intel 18A in 2025.

Within client, we are defining and leading the AI PC category. IDC indicates the overall PC market is now expanding. And as stated earlier, as standards emerge and applications begin to take advantage of new AI-embedded capabilities, we see demand signals improving, especially in second half of the year helped by a likely corporate refresh.

Our core ultra-ramp led by Meteor Lake continues to accelerate beyond our original expectation with units expected to double sequentially in Q2, limited only by our supply of wafer level assembly. Improving second half Meteor Lake supply and the addition of Lunar Lake and Arrow Lake later this year will allow us to ship in excess of our original 40 million AI PC CPU target in 2024.

Next year with Panther Lake, we will extend our lead with Intel 18A and further product enhancements. Our share position is strong and continues to strengthen as we execute on our product roadmap.

Within DCAI, as committed, we have achieved product release on our first Intel 3 server product, the first generation E-Core Xeon 6 codename Sierra Forest. The next-generation P-Core Xeon 6 product, Granite Rapids will be released in Q3. At Vision, we demonstrated the 70 billion parameter model running natively on Xeon 6 with good performance.

We continue to expect share trends to stabilize this year before improving in 2025. While budgets are still being prioritized to generative AI build-out where we have a strong position in the head node, customer conversations continue to show improving signs for traditional CPU refresh starting in late Q2 and into the second-half.

Our first Intel 18A product, Clearwater Forest is slated to launch next year and will allow us to accelerate share gains. Our Gaudi 3 launch gave us a strong offering to improve our position in accelerated computing for the data-center and cloud. We now expect over 500 million in accelerated revenue in second half of 2024 with increasing momentum into 2025 based on Gaudi 3's vastly superior TCO as well as our own expanding supply.

In addition, we are finding good traction with the Intel Developer Cloud with customers onboarding with this platform, including Dell and Seekr, our largest IDC win to date. We are encouraged by our progress, but far from satisfied.

Lastly, within NEX, the business has stabilized and beat our Q1 targets with channel inventories approaching normal levels and business acceleration expected through the year as a result. We also recently announced our plans for scale-up and scale-out Ethernet-based AI networking delivered as a discrete NIC and chiplets for AI foundry customers with numerous key providers in the industry and market standardization through the Ultra Ethernet consortium.

So that is Intel products, good momentum and a lot for us to build on. Let me turn to Intel Foundry. We are executing on our strategy to drive meaningful improvement in profitability over-time. We are obviously not there yet given the large upfront investment we needed to build-out this business, but we always said this was going to be a multi-year plan and we are right on track with where we expect it to be right now.

As we discussed during our webinar at the beginning of the month, the transition from pre-EUV wafers to post-EUV wafers is a powerful tailwind for us. We expect our blended average wafer pricing to grow 3x faster than cost over the decade, driving significant margin expansion.

In addition, more competitive wafers will allow us to bring home many of the tiles that today are being manufactured at external foundries. Both dynamics are in our control and not dependent on revenue growth and are key elements to drive the business to breakeven, more than doubling our current earnings power at the Intel consolidated level.

Of course, more competitive wafers combined with our position as the only company manufacturing with leading-edge wafers outside of Asia is drawing strong interest from potential external customers. It is important to note that our leadership in advanced packaging creates more value in our wafer technologies and wafer level assembly and base dye opportunities further fill our factories and extend the useful life of our tools for increased financial returns.

I am pleased to announce that this quarter, we signed another meaningful customer on Intel 18A, bringing our total to six. A leader in the aerospace and defense industry, this customer chose Intel Foundry based not only on the process technology benefits of Intel 18A, but also because of their desire to have a secure US only supply base.

Just this week, we were very pleased to announce that the DoD awarded Intel Foundry Phase 3 of the RAMP-C Program, which we are confident will lead to additional federal aerospace and defense customers.

More broadly, we are seeing growing interest in Intel 18A and we continue to have a strong pipeline of nearly 50 test chips. The near-term interest in Intel Foundry continues to be strongest with advanced packaging, which now includes engagements with nearly every foundry customer in the industry, including five design awards. While we are highly focused on improving the near-term profitability of Intel Foundry, it is also important that we keep sight of the long-term opportunity here.

The foundry market is expected to grow from $110 billion today to $240 billion by 2030 with almost 90% of the growth coming from EUV nodes and advanced packaging. Given this backdrop, we have clear line-of-sight to becoming the largest system foundry for the AI era and the second-largest overall by 2030, building on our EUV High NA process technology, leadership in advanced packaging, manufacturing capacity, our systems expertise and the surge in AI demand.

Put it another way, our 15 billion of external revenue embedded in our Intel Foundry target model would represent less than 15% of the leading-edge foundry market. It is not a question of if, but when Intel Foundry achieves escape velocity. And every day, we are proving to the market that Intel Foundry is a resilient, sustainable and trusted alternative to serve a semi-market on a path to top 1 trillion by the end of the decade.

Let me wrap up by speaking to our all other category, where our number one priority is to unlock shareholder value. This quarter, we formally rebranded our programmable solutions group, Altera, an Intel company. We look forward to bringing in a private equity partner this year to help prepare the company for an IPO in the coming years. This puts Altera on a similar path as Mobileye.

We are excited about the future of both companies. By providing them with separation and autonomy, we believe we enhance their ability to capitalize on their growth opportunities in their respective market and accelerate their path to create value.

Combined with IMS, our mask writing equipment business, we believe these three assets represent more than a quarter of our overall market value today. Along with a solid Intel products franchise and an Intel Foundry business rapidly approaching 100 billion in net tangible assets, we see the opportunity to unlock significant value for our shareholders as we meet our financial commitments, stand-up Intel Foundry and drive it to profitability and further leverage our opportunity in AI.

So overall, I'll say that there is a lot for us to build on coming out of Q1. We are systematically executing to our strategy and we are making steady progress. We are maniacally focused on executional excellence and fiscal discipline and we are relentless in our drive to regain process leadership and bring next-generation solutions to solve our customers' hardest problems. All of this gives me confidence in where we are headed.

Yes, we have a lot of hard work in front of us, but we know what we need to do and the payoff will be significant in the end. Semiconductors are the currency that will drive the global economy for decades to come. We are one of two, maybe three companies in the world, that can continue to enable next-generation chip technologies and the only one that has Western capacity in R&D. And we will participate in the entire AI market. Quarter-by-quarter, we are positioning ourselves well to capitalize on the immense opportunities ahead.