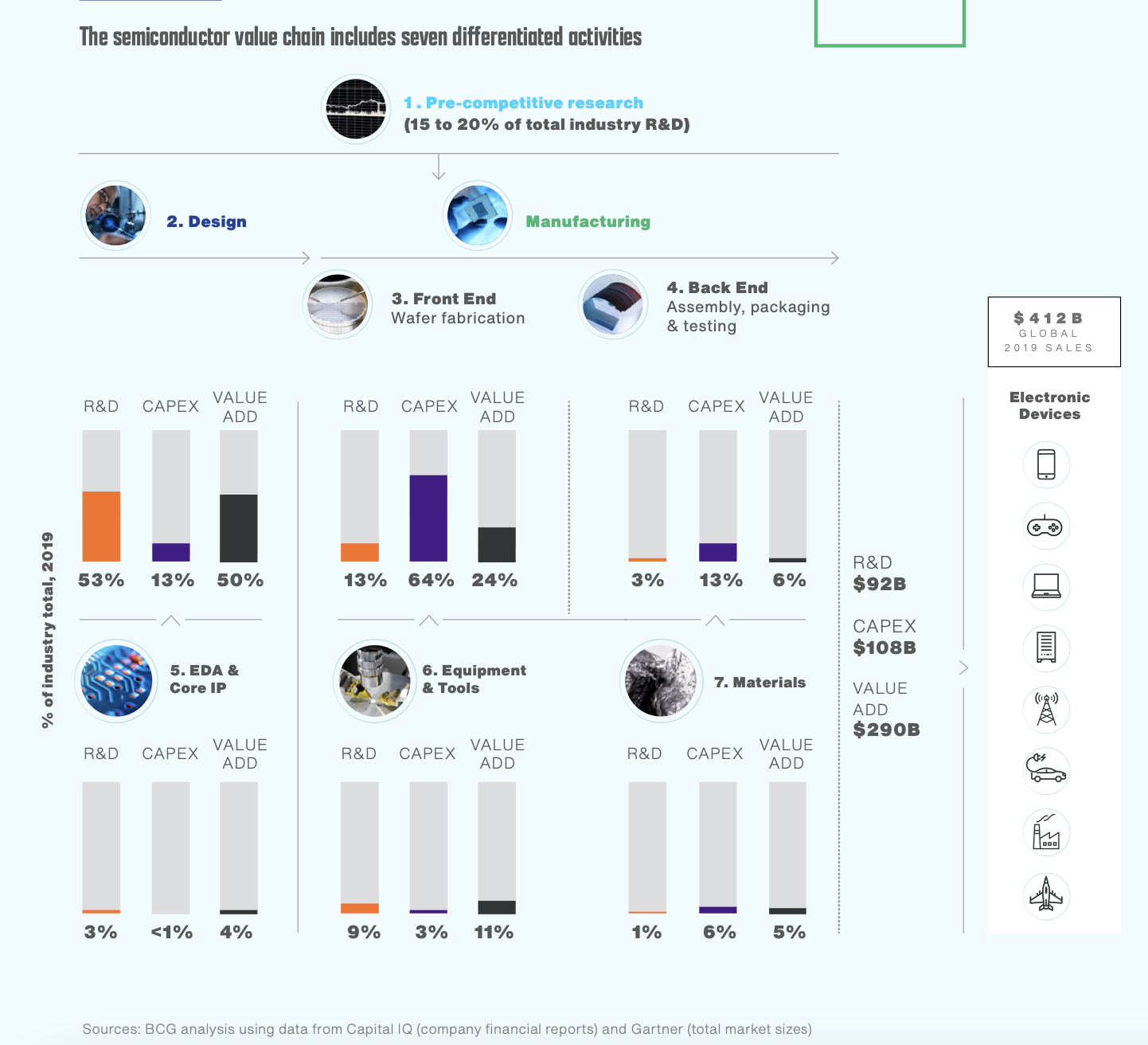

Dear experts, I have a question regarding the semiconductor market value chain. According to this illustration (below), the semiconductor value chain is derived from seven activities (pre-competitive research/design/frontend/backend/EDA/equipment/material). Each activity is further divided into three major categories: R&D, Capex, and Value add.

While R&D represents research and development, and Capex represents asset investment;

What does Value add represent in the illustration? Any insights on this would be greatly appreciated

While R&D represents research and development, and Capex represents asset investment;

What does Value add represent in the illustration? Any insights on this would be greatly appreciated