FILE PHOTO: Illustration shows TSMC (Taiwan Semiconductor Manufacturing Company) logo

(Reuters) - Taiwanese chipmaker TSMC has developed the most expansive arsenal of patents surrounding advanced chip packaging, followed by Samsung Electronics and then Intel, according to data from LexisNexis.

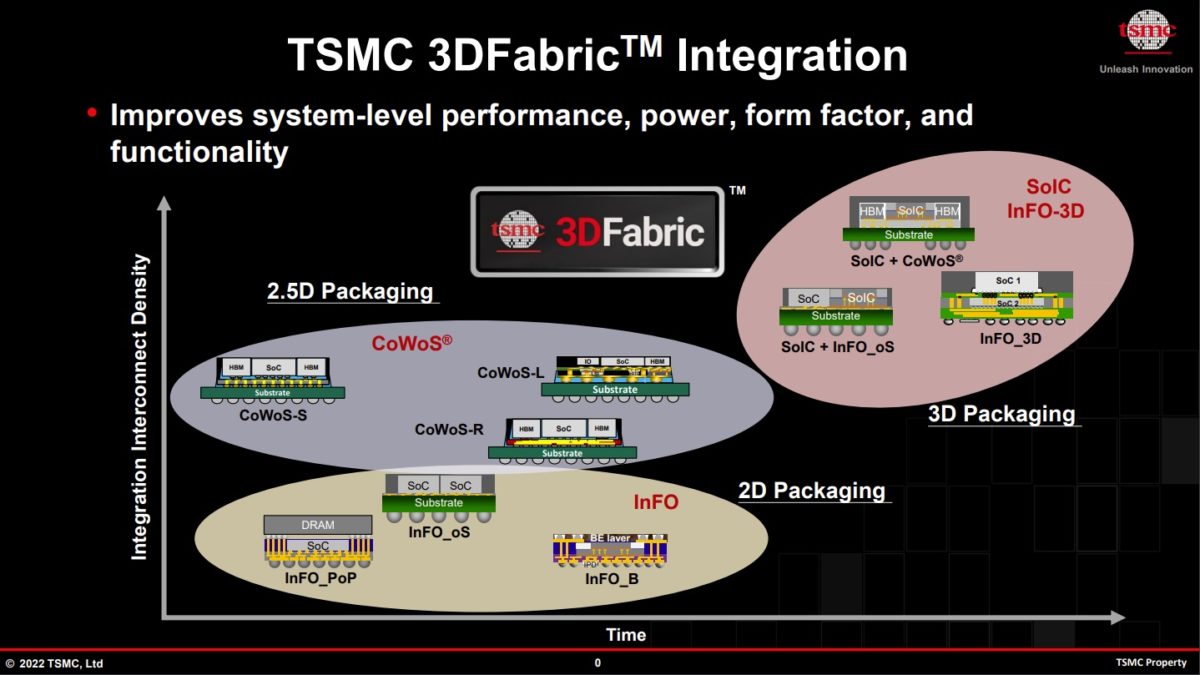

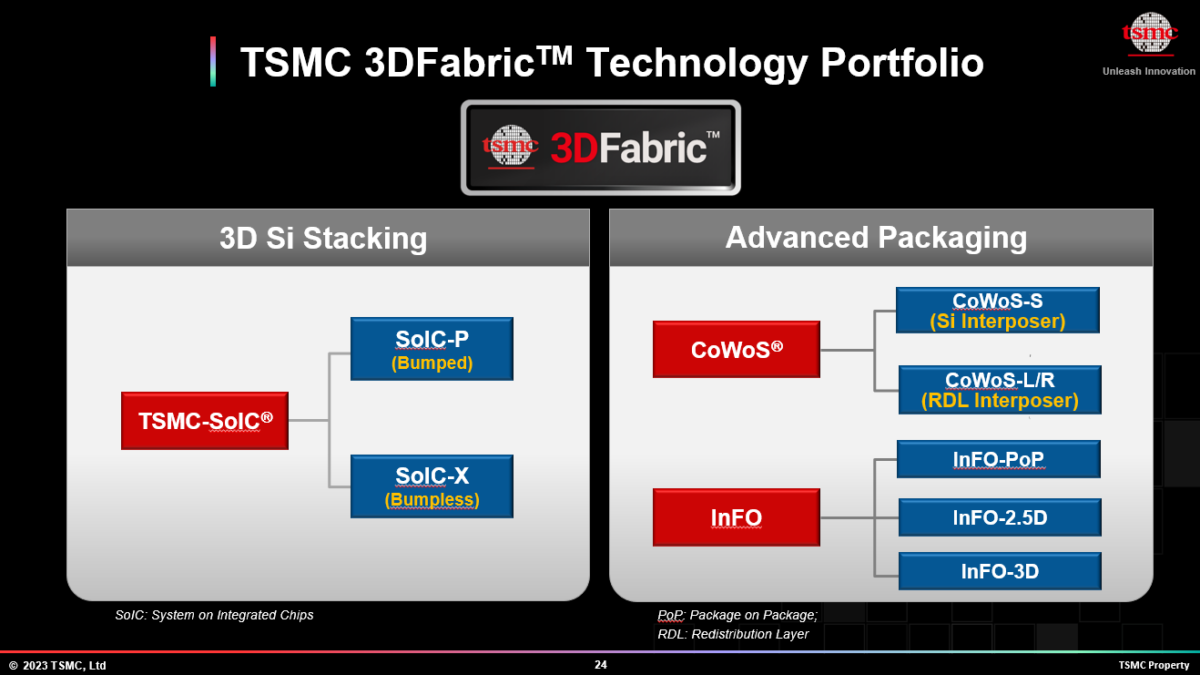

Advanced chip packaging is a crucial technology that squeezes the most horsepower from the latest chip designs, and is crucial to chip contract manufacturers vying for business.

The data from LexisNexis, released last month, indicates that TSMC and Samsung have steadily invested in advanced packaging technology for years, as Intel did not keep pace with its own filings.

Taiwan Semiconductor Manufacturing (TSMC) has a cache of 2,946 advanced packaging patents and also has the highest quality, a measure that includes how many times they are cited by other companies, according to data and analytics company LexisNexis.

Samsung Electronics, which ranks second in terms of quantity and quality of the patents, has 2,404, according to the LexisNexis data.

Ranked third, Intel has 1,434 patents in its advanced packaging portfolio.

“They seem to be the ones that pulled the field forward, and set the technology standard,” said LexisNexis PatentSight Managing Director Marco Richter in an interview, referring to TSMC, Samsung and Intel.

Intel, Samsung and TSMC have been steadily investing in advanced packaging technology since around 2015, when all three began to add to their patent portfolios, according to the data. The three businesses are the only companies in the world that have or plan to deploy the technology to fabricate the most complex, advanced chips.

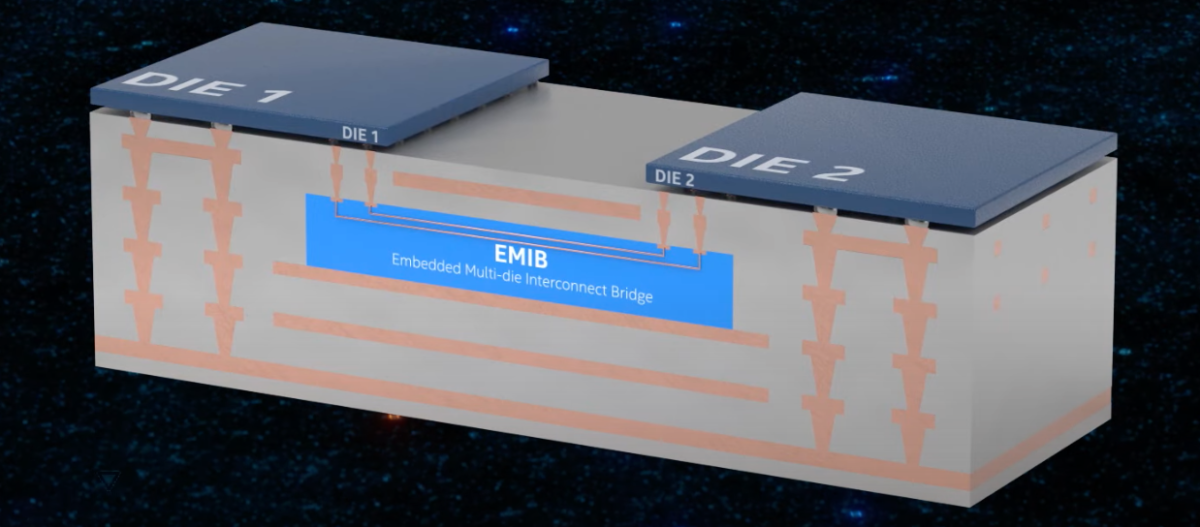

Advanced packaging is crucial for improving semiconductor designs as it becomes more difficult to pack more transistors onto a single piece of silicon. Packaging technology enabled the industry to stitch together several chips called "chiplets" - either stacked or adjacent to one another - within the same container.

Advanced Micro Devices' chiplet technology helped its server chips gain an advantage over Intel's.

Samsung has been investing in advanced packaging for years but the South Korean chip giant established a dedicated team to pursue advanced packaging in December 2022, Moonsoo Kang, the unit's chief, said in a statement.

Intel disputed the idea that the size of TSMC's patent portfolio indicated that it had developed more advanced technology. The company's patents protect its intellectual property rights, and its patent investments are carefully selected, Intel's vice president of intellectual property legal group, Benjamin Ostapuk, said in a statement.

TSMC declined to comment.

Why I'm Buying These 5 Chip Stocks Over Nvidia

Nvidia benefits as companies continue investing in AI, but its valuation needs to cool off before I consider adding more to my portfolio.