TSMC prizes Japan's chips skills after US stumbles -sources

BY Reuters— 7:12 PM ET 09/12/2023

By Sam Nussey, Fanny Potkin and Sarah Wu

TOKYO/SINGAPORE/TAIPEI (Reuters) - Taiwan's TSMC, which is making an unprecedented push into chip manufacturing overseas, is taking an increasingly optimistic view of Japan as a production base, two industry sources said, as problems persist at its new factory in Arizona.

TSMC, the world's largest contract chipmaker, is frustrated in Arizona, the sources said, where it has struggled to recruit workers for the gruelling chipmaking trade and faced pushback from unions on efforts to bring in workers from Taiwan.

The company has growing confidence in Japan, where an $8.6 billion fab under construction in a chipmaking hub on the island of Kyushu is on track to start producing mature-technology chips in 2024, the sources said.

While keen to ensure a smooth ramp up at the first fab, the chipmaker is considering adding capacity and a second fab in Japan, the sources said, which could include the production of more advanced chips.

Several chip industry sources spoke to Reuters about TSMC's view of Japan and its global expansion on condition of anonymity because of the sensitivity of the matter.

Successful expansion by TSMC in Japan could give a boost to efforts by the country to regain its lost status as a chip manufacturing powerhouse and support its automotive and electronics industries amid growing regional competition.

TSMC said in a statement its overseas expansion depends on factors including the needs of customers, the level of government support and cost considerations.

In Arizona, TSMC plans to produce advanced chips but a shortage of skilled workers has forced the company to push back production at its first fab by a year to 2025.

"Any project... will have some learning curve. In the past five months the improvement has been tremendous," TSMC Chairman Mark Liu said of the Arizona project last week.

Fabs in the U.S., Japan and Germany, where it is also expanding, are "inherently incomparable" due to differences in location, setup and scope, TSMC said.

NATURAL FIT

The U.S., Japan and Germany have offered TSMC billions of dollars in subsidies for it to localise production in efforts to diversify the supply of chips, which are essential to the defence, automotive and electronics industries.

The $40 billion investment in Arizona allows TSMC to add capacity outside Taiwan, where it faces constraints on land, power, water and labour.

But the company views Japan as a more natural fit in terms of work culture, and its government is easy to deal with and generous with subsidies, the sources said.

"The relationship between TSMC and the Japanese government is mutually beneficial," said Lucy Chen, an analyst at Isaiah Research.

Japan's advantages for the chipmaker include its network of chip equipment and materials suppliers, similarities in work culture and proximity to Taiwan, she added.

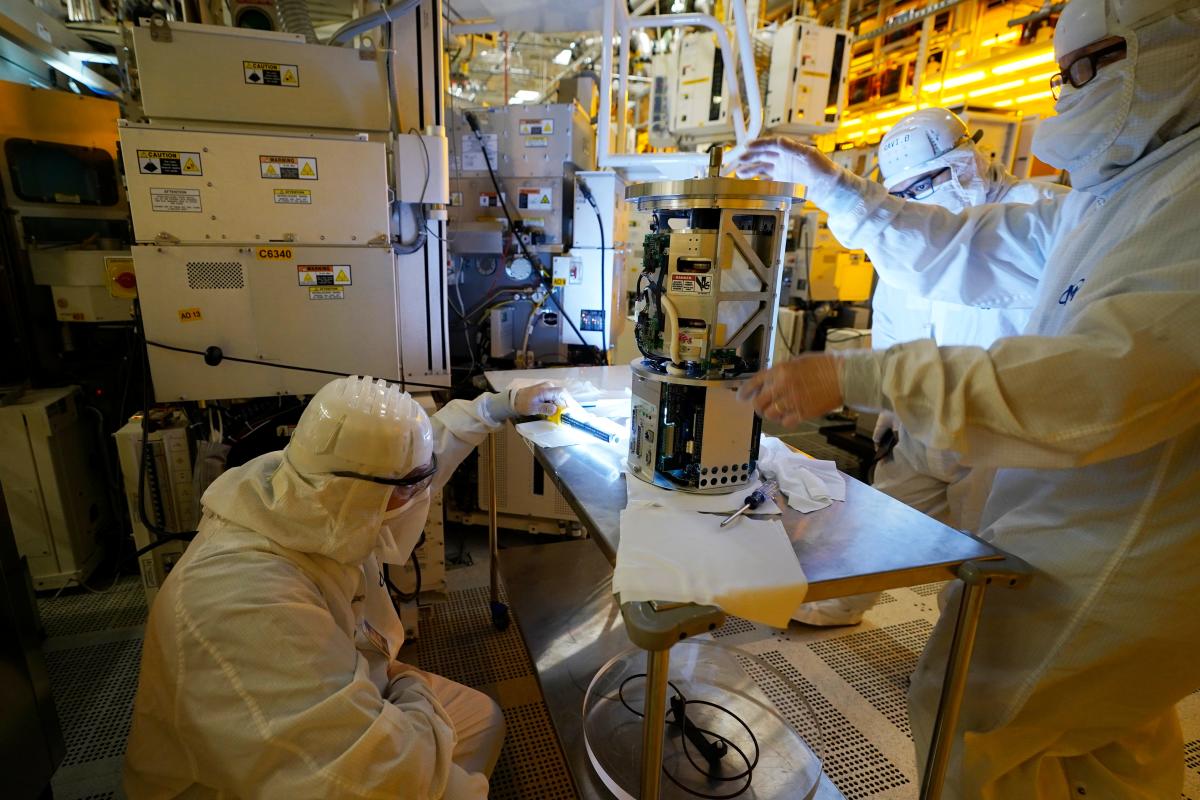

TSMC sees workers in Japan, which is known for long hours and strong commitment to employers, as more willing to work a punishing schedule with overtime as chipmaking machines run around the clock in sterile clean rooms, the sources said.

"A lot of machines cannot be shut down because it costs TSMC to recalibrate on rebooting," said a chip industry executive.

It is only a two-hour flight to Kyushu, where TSMC is partnering with companies including Sony, a leading maker of image sensors.

Taiwanese workers arriving to help set up the fab are welcome, and the chipmaker will pay higher wages to secure local employees as it competes with rivals such as foundry venture Rapidus, the sources said.

"It seems to us that TSMC is really positive about investment in Japan," said a senior official at the powerful Ministry of Economy, Trade and Industry (METI), which has offered subsidies worth up to 476 billion yen ($3.23 billion) for the first fab.

"We will really welcome the second fab project in general but we have to see the detail first," the official said.

While many equipment and materials makers already have global operations, to meet its exacting standards TSMC has also brought suppliers to Japan from Taiwan, the sources said.

RISING CAPITAL SPENDING

TSMC's enthusiasm for Japan is being tempered by concerns about higher costs across the business and worries about the macro environment, the sources said.

Capital expenditure ballooned to $36 billion last year from $10 billion in 2018, with the company forecasting a slightly smaller outflow this year.

TSMC thought costs to build a fab would be 20% higher in the U.S. than in Taiwan but they are actually about 50% higher, an investor briefed by company management said.

The chipmaker plans to build an $11 billion fab in Germany with local firms but is also concerned the work culture there, with long vacations and strong unions, will hit output, the sources said.

Investors worry about the effect of higher costs but "the impact on TSMC today has not been that big because its leading technology gives it pricing power," said Brady Wang, an analyst at research firm Counterpoint.

($1 = 147.2300 yen)

(Reporting by Sam Nussey, Fanny Potkin and Sarah Wu; Additional reporting by Miho Uranaka; Editing by Jamie Freed)