We have seen in a previous post that Imagination Technologies has proposed to buy MIPS, in fact “MIPS operating business and certain patent properties, as well as license rights to all of the remaining patent properties”. Translated into understandable language Imagination has offered $60M for MIPS Processor IP core portfolio, plus the patents considered as essential to protect the portfolio, a couple of weeks ago. ARM did not participate to this bid, but the company is leading “Bridge Crossing LLC, a consortium of major technology companies affiliated with Allied Security Trust, which has entered into an agreement with MIPS to obtain rights to its patent portfolio. The MIPS patent portfolio includes 580 patents and patent applications covering microprocessor design, system-on-chip design and other related technology fields. The consortium will pay $350 million in cash to acquire rights to the portfolio, of which ARM will contribute $167.5 million.”

This was the status until a news in the Wall Street Journal came this week, announcing that MIPS has received an unsolicited offer from CEVA, putting $75M on the table to acquire MIPS operating business, bidding against Imagination Technologies for exactly the same asset. In other words, the bid from Bridge Crossing LLC is still valid, and CEVA only bid for MIPS operating business. Although it’s always interesting to see serious people playing “Monopoly” (the game) in real time, there are some interesting strategies being tentatively built here.

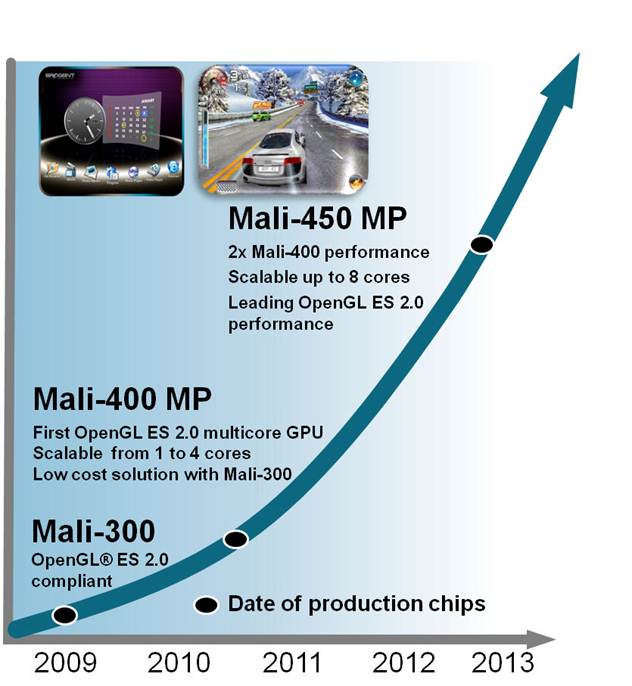

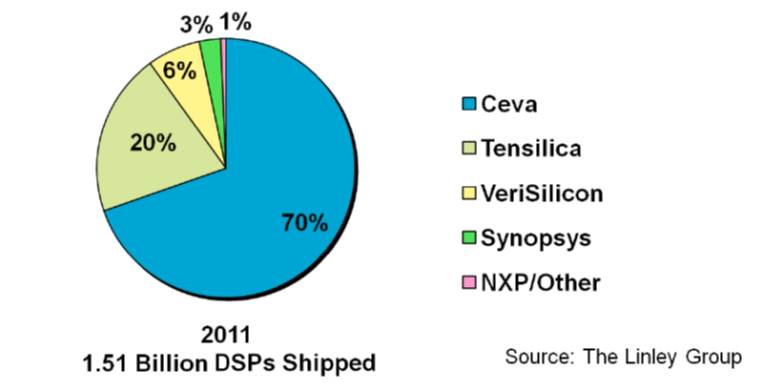

Let’s concentrate on this part of the story. Unlike MIPS, CEVA and Imagination Technologies have been successful in the wireless phone application area, CEVA selling DSP IP based solution for the baseband processing (see for example this post), and Imagination providing GPU IP cores to Application Processor chip makers (at least to those not using internal solution like Qualcomm). If CEVA can be considered as the counterpart of ARM, one dominant with DSP IP core when the other is (ultra) dominant with the Processor IP cores, Imagination Technologies is challenged by a couple of GPU IP vendors, even if they have slightly less than 50% market share, one of the challengers being… ARM with MALI GPU.

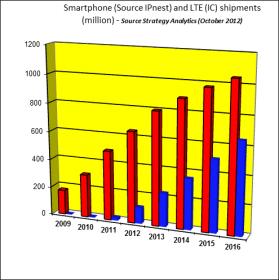

The smartphone market segment (see this forecast below) is certainly very attractive…

So, the motivation of CEVA and Imagination Technologies appears to be different, even if the target may be the same: the smartphone segment. If ARM becomes more and more successful with MALI, the company will ultimately kick Imagination Technologies out of the smartphone segment, which is certainly the most lucrative in term of (royalties) revenue. The bid from Imagination for MIPS illustrates one of the oldest strategy paradigms: “attack is the best defense” (from Carl von Clausewitz). As a matter of fact, if Imagination is able to propose both the CPU and the GPU IP, this strategy could be efficient to win some new customers against ARM (I don’t think they could displace ARM CPU IP at large accounts where the existing investment is huge), and it will complicate ARM selling process for their core business, the CPU, leaving less time to sell the MALI GPU.

If the bid from CEVA on MIPS is successful, it can be considered at 100% as an offensive (CEVA is not attacked by ARM on his core market), the goal being either to expand the revenue at accounts where CEVA is already present with their DSP IP, either to design-in DSP and CPU IP at emerging chip makers, with the same difficulties that already above mentioned: it will be really challenging to replace ARM CPU IP at accounts being long term ARM customers…

Let’s imagine that CEVA finally win the bid (I would guess that we are only at the beginning of the “Monopoly”, let say the first quarter), then, we may expect an interesting reaction from ARM, like buying one of the (very few) CEVA competitor, for example… (but I did not mention Tensilica).

Eric Esteve – IPNEST

Share this post via:

Comments

0 Replies to “CEVA also bid to acquire MIPS… ARM still staying quiet?”

You must register or log in to view/post comments.